Living Environment Rwake County Property Tax Rate 2024 Calculations – While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . Homeowners in multiple towns across Wake County could see their property rate for the 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral .

Living Environment Rwake County Property Tax Rate 2024 Calculations

Source : issuu.com

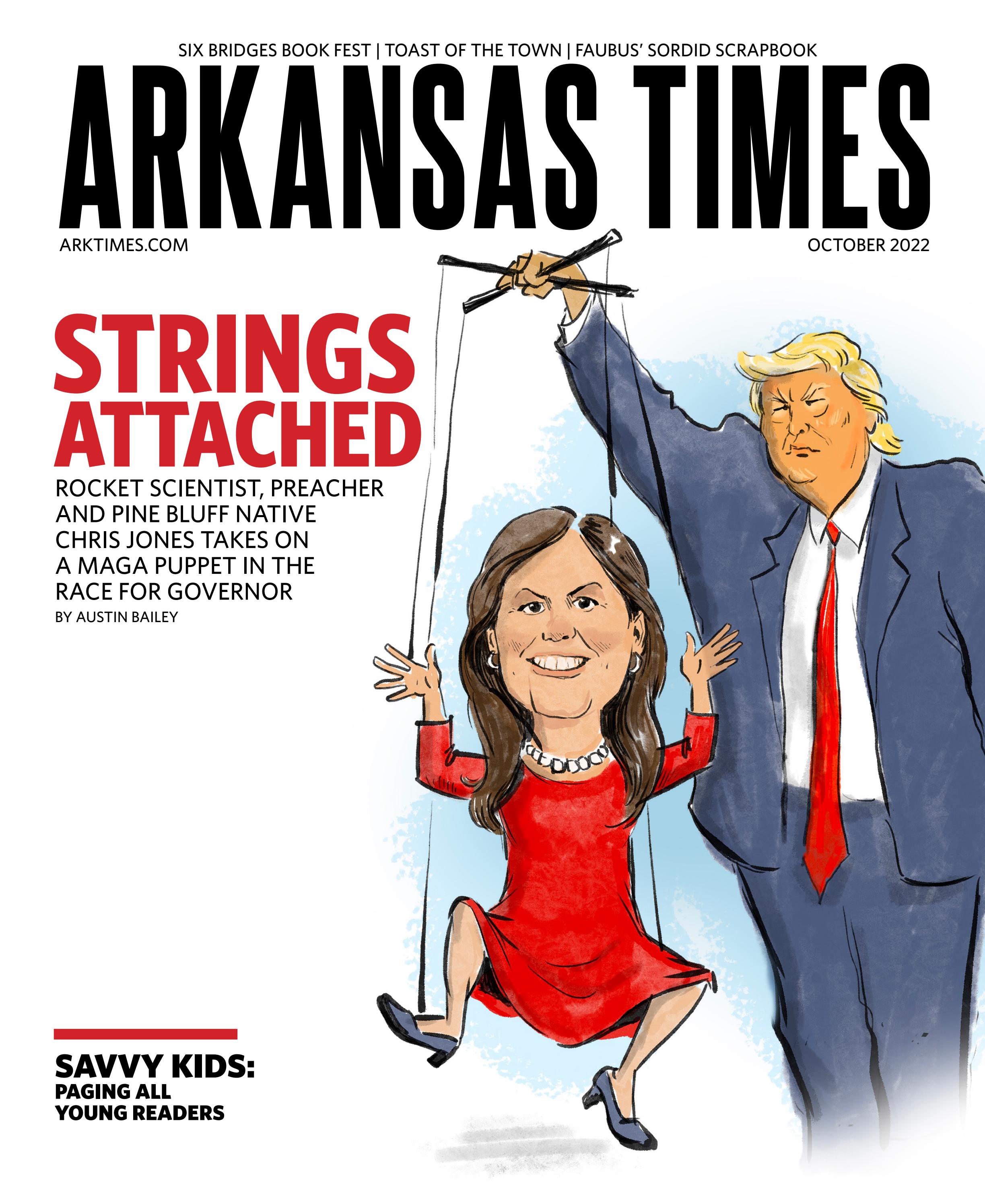

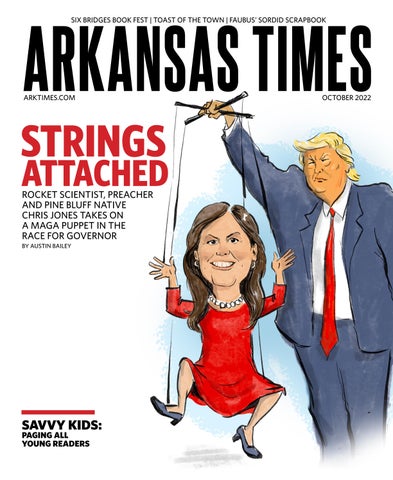

Arkansas Times | October 2022 by Arkansas Times Issuu

Source : issuu.com

AR Times 3 11 by Arkansas Times Issuu

Source : issuu.com

Arkansas Times | October 2022 by Arkansas Times Issuu

Source : issuu.com

Arkansas Times | October 2022 by Arkansas Times Issuu

Source : issuu.com

Arkansas Times | October 2022 by Arkansas Times Issuu

Source : issuu.com

Ar times 8 15 13 by Arkansas Times Issuu

Source : issuu.com

http://assets.mediaspanonline.com/prod/5630687/12272010 SLS A01 by

Source : issuu.com

Arkansas Times August 21, 2014 by Arkansas Times Issuu

Source : issuu.com

Arkansas Times Aug. 22, 2013 by Arkansas Times Issuu

Source : issuu.com

Living Environment Rwake County Property Tax Rate 2024 Calculations Arkansas Times | October 2022 by Arkansas Times Issuu: The Wake County Board of Commissioners got its first look at the 2024 calculator to help property owners see what their new tax bill would be if the county were to adopt the revenue-neutral . said at Tuesday’s reorganization meeting that while the county’s property tax rate will “freeze” in 2024, the county will embark on new programs to aid local municipalities. Kuhl, who previously .